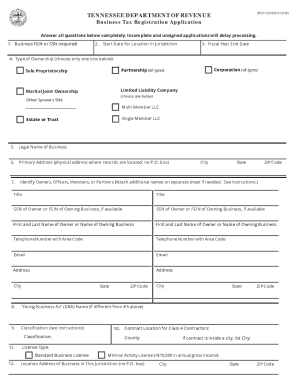

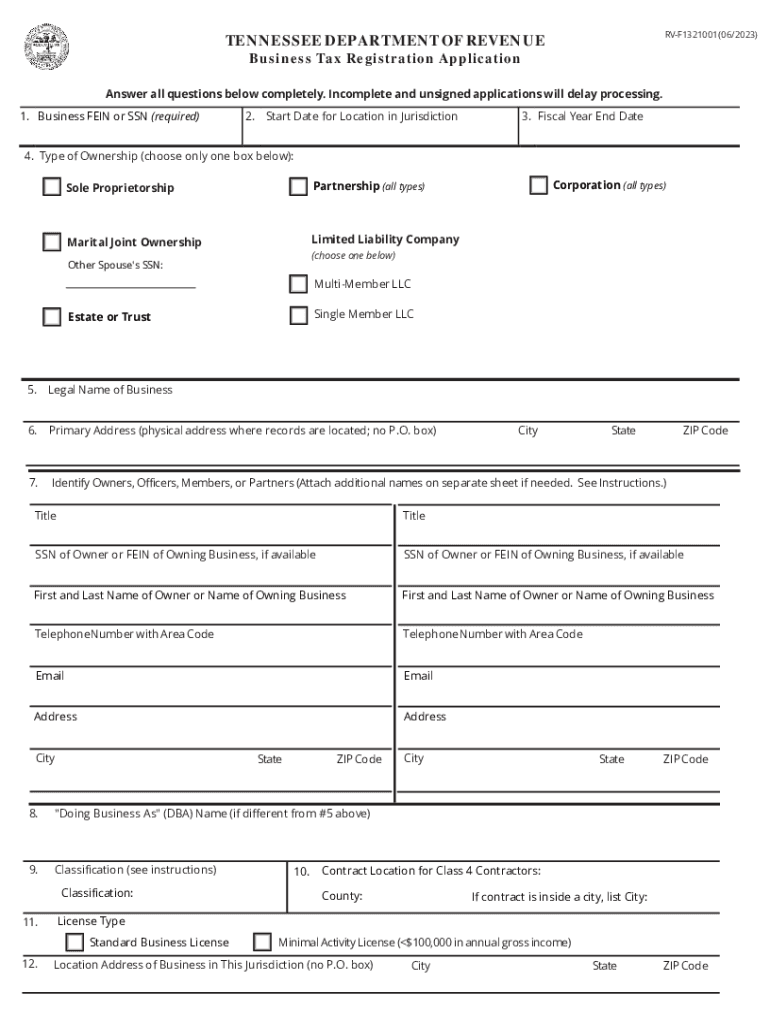

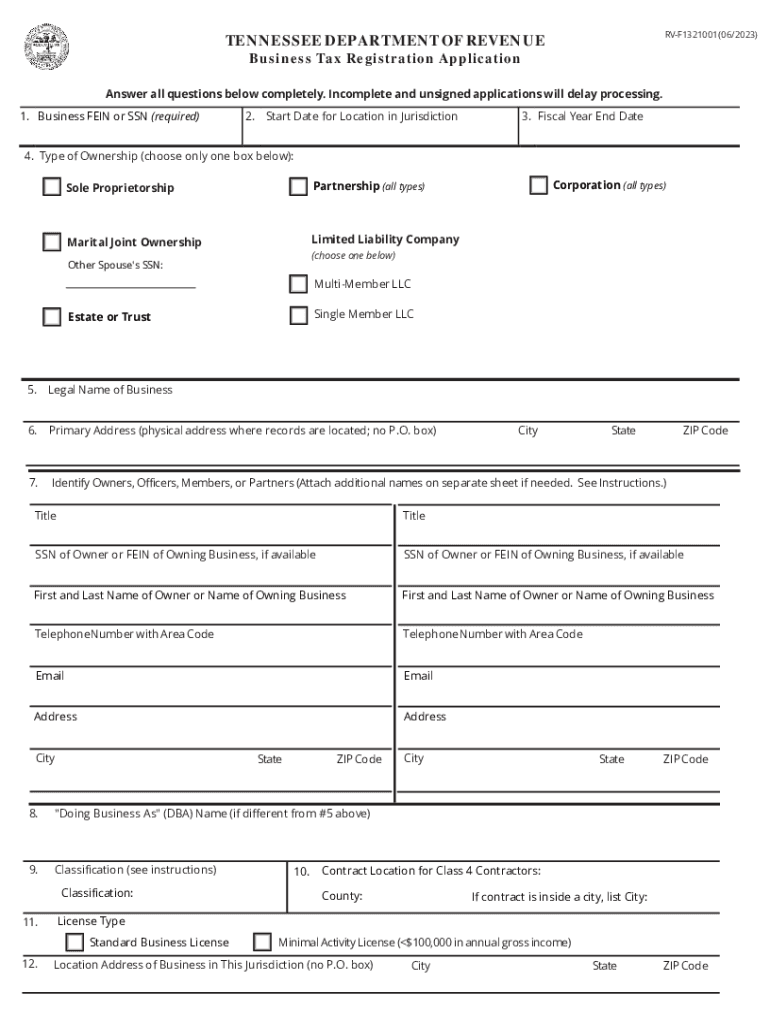

TN RV-F1321001 2023-2026 free printable template

Show details

This document serves as an application for tax registration for businesses in Tennessee. It outlines the required information, such as ownership type, legal name, address, and contact details, necessary

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign business license tn form

Edit your tennessee business license form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tn business license form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing what does a tn business license look like online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tennessee registration form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TN RV-F1321001 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out business tax registration application form

How to fill out TN RV-F1321001

01

Begin by downloading the TN RV-F1321001 form from the official website.

02

Fill in your personal information including your name, address, and contact details in the designated sections.

03

Provide any necessary identification numbers, such as your driver's license or Social Security number.

04

Carefully read the instructions provided on the form to ensure accurate completion.

05

Indicate the purpose of the application or the specific services you are requesting.

06

If applicable, include any supporting documents that may be required.

07

Review the completed form for accuracy and completeness before submitting.

08

Submit the form as instructed, either by mail, online, or in person, based on the guidelines.

Who needs TN RV-F1321001?

01

Individuals seeking to apply for or renew certain permits or licenses related to vehicles in Tennessee.

02

Residents who need to report changes to their vehicle registration details.

03

Those who are required to prove compliance with vehicle-related regulations.

Fill

tennessee business license form

: Try Risk Free

People Also Ask about business license tennessee

Are businesses taxed on revenue or profit?

A corporate tax is a tax on the profits of a corporation. The taxes are paid on a company's taxable income, which includes revenue minus cost of goods sold (COGS), general and administrative (G&A) expenses, selling and marketing, research and development, depreciation, and other operating costs.

Do you have to file if you made under 5000?

Do You Have to File Taxes If You Made Less than $5,000? Typically, if a filer files less than $5,000 per year, they don't need to do any filing for the IRS. Your employment status can also be used to determine if you're making less than $5,000.

Do I need a CRA account for my business?

The most common CRA program accounts a business may need are: GST/HST (RT), if your business collects GST/HST. Payroll deductions (RP), if your business pays employees. Corporation income tax (RC), if your business is incorporated.

How long can a small business go without paying taxes?

The IRS expects every business to file a federal tax return and pay taxes every year. So the real answer to that question is (drumroll please): Zero. There are no IRS-issued guidelines or allowances that will let you skip filing taxes for a year.

Do you have to file business taxes if under $30000?

If you carry on commercial activities in Québec and your business income and the business income of your associates exceeds $30,000, you must register for the GST/HST and QST. If your business income and the business income of your associates does not exceed $30,000, see Details Concerning Small Suppliers.

Is CRA business account different from personal account?

Please remember that they are two separate accounts; make sure you register for both. Step 1 - Go to the CRA My Account for Individuals website.

How much does a business have to make to claim taxes?

See Publication 334, Tax Guide for Small Business (For Individuals Who Use Schedule C) for more information. You have to file an income tax return if your net earnings from self-employment were $400 or more.

Do I have to file taxes if my business made less than 5000?

Do You Have to File Taxes If You Made Less than $5,000? Typically, if a filer files less than $5,000 per year, they don't need to do any filing for the IRS. Your employment status can also be used to determine if you're making less than $5,000.

Does a sole proprietor need a CRA account?

A CRA program account is necessary to meet certain tax obligations and to receive some benefits, refunds, and rebates. If your sole proprietorship has no employees and is not required to register for GST/HST, you do not need a CRA program account.

How much money does a small business have to make before filing taxes?

See Publication 334, Tax Guide for Small Business (For Individuals Who Use Schedule C) for more information. You have to file an income tax return if your net earnings from self-employment were $400 or more.

What is the lowest you can make without filing taxes?

Under age 65. Single. Don't have any special circumstances that require you to file (like self-employment income) Earn less than $12,950 (which is the 2022 standard deduction for a single taxpayer)

How do I get CRA online for my business?

My Business Account Enter your social insurance number. Enter your date of birth. Enter your current postal code or ZIP code. Enter an amount you entered on one of your income tax and benefit returns. Create a CRA user ID and password. Create your security questions and answers.

How do I create a CRA account for my business?

My Business Account Enter your social insurance number. Enter your date of birth. Enter your current postal code or ZIP code. Enter an amount you entered on one of your income tax and benefit returns. Create a CRA user ID and password. Create your security questions and answers.

Can I start a business without registering it Canada?

Most businesses need to register with the provinces and territories where they plan to do business. In some cases, sole proprietorships operating under the name of the business owner do not need to register. See the website of your provincial or territorial business registrar for more information on their requirements.

Do I need to register with CRA?

If you are a new user, you have to register before you can use any of our CRA sign-in services.

How much money can you make before you have to register as a business Canada?

Any business that makes over $30,000 a year has to register for a GST/HST number and collect the affiliated sales taxes, depending on the province. If your business is under $30,000 of revenue, you can still register for a GST/HST number, but it's not mandatory.

How do I get my CRA code online?

If you are ready to file your income tax and benefit return but have misplaced your NETFILE access code, you can visit the Canada Revenue Agency's (CRA) Web site, enter your information, and receive your access code instantly!

Do I need to register my business with CRA?

If your business needs to confirm their account number(s), you will need to contact the CRA . If the business later incorporates, you will need to register for a new business number.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tennessee business tax license without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your business license application form into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I edit business registration form in Chrome?

business registration form pdf can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit how to fill out business license application on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign tennessee business license search on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is TN RV-F1321001?

TN RV-F1321001 is a tax form used in Tennessee for reporting and calculating various taxes related to vehicles, such as sales tax or use tax on the purchase of a vehicle.

Who is required to file TN RV-F1321001?

Individuals or entities that purchase a vehicle in Tennessee and need to report and pay applicable taxes must file TN RV-F1321001.

How to fill out TN RV-F1321001?

To fill out TN RV-F1321001, you need to provide information such as the buyer's details, vehicle identification number (VIN), purchase price, and any exemptions if applicable. Follow the instructions provided on the form.

What is the purpose of TN RV-F1321001?

The purpose of TN RV-F1321001 is to facilitate the reporting and payment of taxes associated with the purchase of motor vehicles in Tennessee.

What information must be reported on TN RV-F1321001?

The information that must be reported on TN RV-F1321001 includes the buyer's name and address, vehicle details (make, model, year, VIN), purchase price, date of purchase, and any exemptions claimed.

Fill out your TN RV-F1321001 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tennessee Business License Application Form is not the form you're looking for?Search for another form here.

Keywords relevant to business tax license tn

Related to tennessee department of revenue application for registration

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.